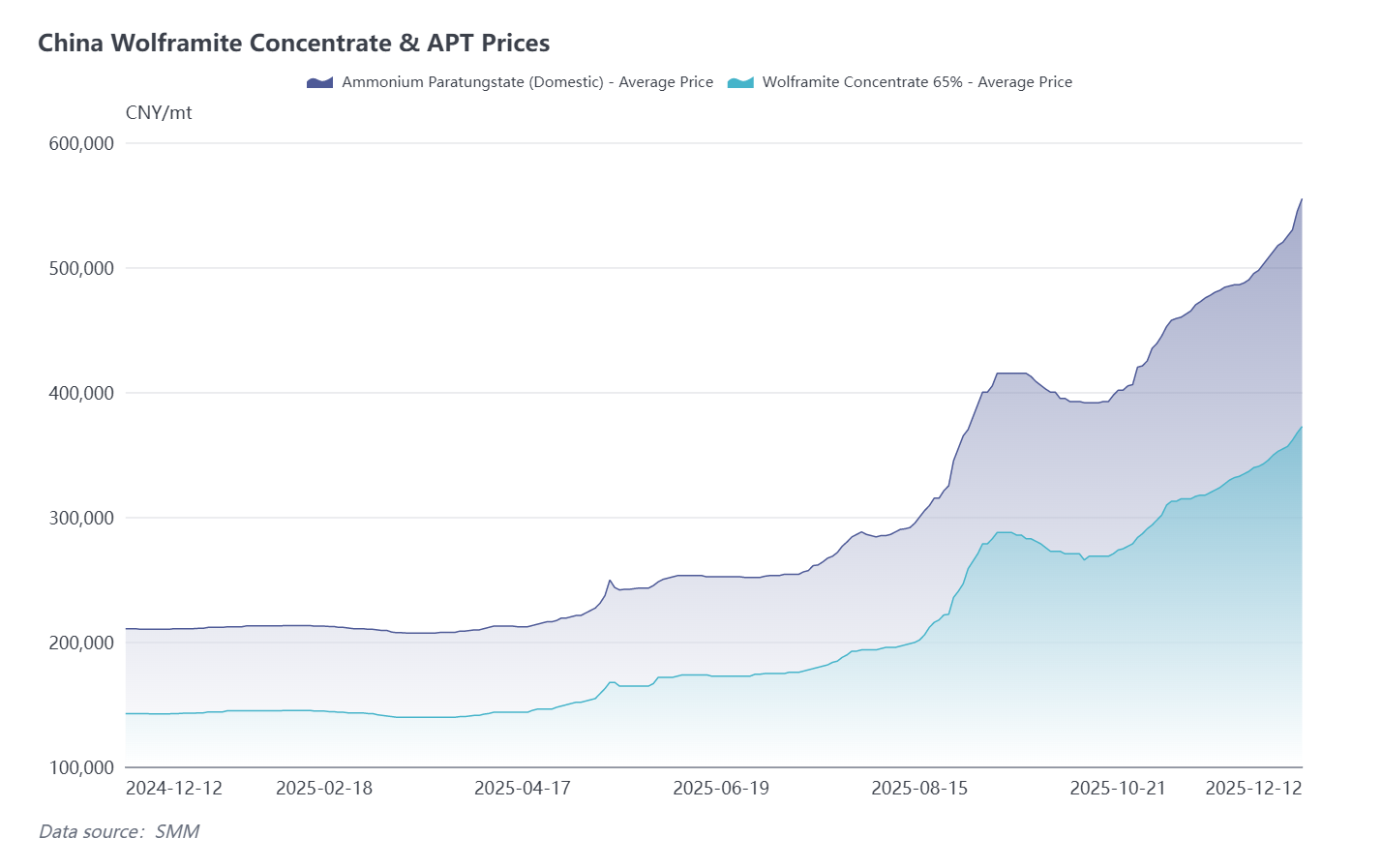

SMM, December 12 - As the end of the year approaches, upstream tungsten mining companies in China have entered a concentrated period of equipment maintenance. Coupled with stricter policy controls and limited remaining available mining quotas, tungsten ore supply tightened this week, leading to a round of "frenzied price increases" in the domestic tungsten market.

As of this Friday, SMM price for 65% wolframite concentrate settled at 372,500 yuan/mt, an increase of 20,000 yuan/mt compared to last Friday. The supply of APT (Ammonium Paratungstate) has significantly decreased, with production halts at some companies boosting market sentiment. The average transaction price for APT has noticeably shifted upward; SMM price for APT settled at 555,000 yuan/mt, up 37,500 yuan/mt from last Friday. In the afternoon, some transaction prices even climbed to a high of 570,000 yuan/mt. Supported by strong cost-side factors, downstream products such as tungsten powder and tungsten carbide mainly followed the upward trend during the week. Among them, tungsten carbide powder settled at 875 yuan/kg, and tungsten powder settled at 905 yuan/kg. Both upstream and downstream industries have fully shifted to individual order-based negotiations, with a notable decrease in market transaction volumes.

The surge in tungsten prices has had varying impacts on different companies across the tungsten industry chain. Below is a summary of perspectives from upstream mining companies, midstream smelting enterprises, and downstream hard alloy and tool manufacturers based on research:

Jiangxi-based Mining Company: Tungsten concentrate prices have risen rapidly recently, with a noticeable shortage in the market, making it difficult for downstream companies to replenish inventory. They primarily fulfill long-term contracts, with minimal spot sales, so significant market price fluctuations have little impact on them. As the year-end approaches, production targets have largely been met, and shipments under long-term contracts will decline. The company also faces declining ore grades, with limited mining and beneficiation capacity, resulting in a year-on-year decrease in output converted to 65% concentrate. Many older mines face similar issues. Quota controls are strict, with natural resource authorities regularly inspecting mining companies' compliance through statistical reports, production records, resource depletion data, and sales and tax invoices to ensure actual mining volumes stay within quota limits. Over-mining in the industry is unlikely.

Hunan-based Mining Company: All output from the mine is used internally within the group. As the year-end approaches, the mine has entered its annual maintenance phase, with no shipments for now. This year's production target has already been met.

Mining Companies in Other Regions: Some mines still have quotas available for the year-end, but production cannot keep up, resulting in low salable inventory. Individual mines in Guangxi and Yunnan conducted bidding sales this week, totaling about 200 physical tons. Mines in Hunan and Henan have not announced bidding or sales plans yet.

Tungsten Concentrate Trading Companies: Trading and operational volumes for tungsten ore and related products have declined recently. On one hand, companies are focused on recouping funds at year-end, and high tungsten ore prices have increased financial pressure. On the other hand, limited market supply makes it difficult to replenish inventory. Additionally, some traders are cautious about the high prices, downstream restocking enthusiasm is low at year-end, and confidence among companies is insufficient.

Downstream APT Enterprises: This week, an APT company in Chenzhou, Hunan, entered a production reduction and maintenance phase. More companies in Jiangxi and other regions are expected to follow with maintenance plans, significantly tightening APT supply. APT prices have accelerated their rise. Downstream powder companies have low inventory and struggle to restock, forcing some to purchase at high prices. In the first half of December, domestic APT long-term contract prices ranged between 520,000-530,000 yuan/mt. Current spot transaction prices are far higher than long-term contract prices, prompting some companies to sell contracted goods to capture price differences.

Powder Companies: Passively raised selling prices, with few new orders. Transactions are primarily negotiated individually, and partial prepayments are often required to lock in prices.

Alloy Companies: Raw material inventory has dropped to low levels, forcing passive restocking. However, end-users often have payment terms of around three months, increasing financial pressure on tool and alloy manufacturers. Some companies are cautious about accepting orders. Overseas market prices are inverted, leading to a noticeable decline in export orders. Some companies report that end-users are considering ceramic products as substitutes for tungsten tools. Small and medium-sized enterprises face difficult choices: raising finished product prices, reducing profit margins, or delaying procurement. Alloy companies lacking capital, technological advantages, or market competitiveness are forced to reduce production or even halt operations to minimize losses.

In summary, reduced shipments from mines at year-end and increased maintenance at APT companies have significantly tightened raw material supply in the upstream tungsten market. The supply-demand imbalance is difficult to resolve, and the current trend of price increases with low trading volumes may persist in the short term, with prices expected to remain high. However, the market should monitor mining companies' shipment patterns in the first quarter of the new year to avoid concentrated sales and increased supply. Additionally, sustained price increases in the tungsten market are testing the resilience of downstream demand. In November, photovoltaic silicon wafer production saw a significant decline, and December production is estimated at 45.7 GW, a nearly 16% decrease month-on-month. Terminal sectors like machinery manufacturing have also entered a seasonal lull, with declining growth expectations potentially dampening the pace of future tungsten price increases.

![Transaction Pushed Magnesium Prices Up, Today's Magnesium Prices Hold Up Well [SMM Analysis]](https://imgqn.smm.cn/usercenter/CkvAg20251217171724.jpg)

![[SMM Magnesium Analysis] China Magnesium Trade Faces Challenges Amid Geopolitical Tensions and Export Controls](https://imgqn.smm.cn/usercenter/teIej20251217171724.jpeg)